We believe in a stable and financially resilient life for everyone.

Financial problems can disrupt someone's life, not only at home but also at work. Financial difficulties can lead to absenteeism, stress, and underperformance. We see financial resilience as a crucial aspect of workplace vitality.

With our platform, we provide employees with a financially resilient future.

.jpg)

The impact of debts on an individual is significant.

For employers, it is crucial that employees can potentially fully utilize their work. Financial resilience is part of this.

The financial situation of an employee is something that an employer does not usually get involved in. Additionally, an employee rarely shares their personal problems with their supervisor. However, financial stress can significantly impact job performance.

Able to:

Source: Nibud Netherlands

The barrier is often too high to ask for help in a timely manner when facing financial problems.

The perception that people should be able to fend for themselves and rely less on the government has resulted in dependency being something to be ashamed of.

Those who can support themselves receive respect, while those who are dependent lose it. As a result, it is difficult to overcome this shame and seek financial assistance in a timely manner.

On average, someone with financial problems waits five years before seeking help. How valuable is it to be able to assist these employees now?

Of people with payment problems do not receive any assistance.

Of Dutch households are financially vulnerable or financially unhealthy.

Of households have experienced payment problems in the past year.

Able. The online platform for financially resilient employees.

We believe that a direct approach in the workplace makes the difference. It allows us to inform people preventively and at an early stage. Additionally, we can provide existing debt cases with a professional, personal, and above all, secure solution.

Through their own environment, the employee has fully anonymous access to our platform. Here, training for detection, prevention tips, and debt assistance is available.

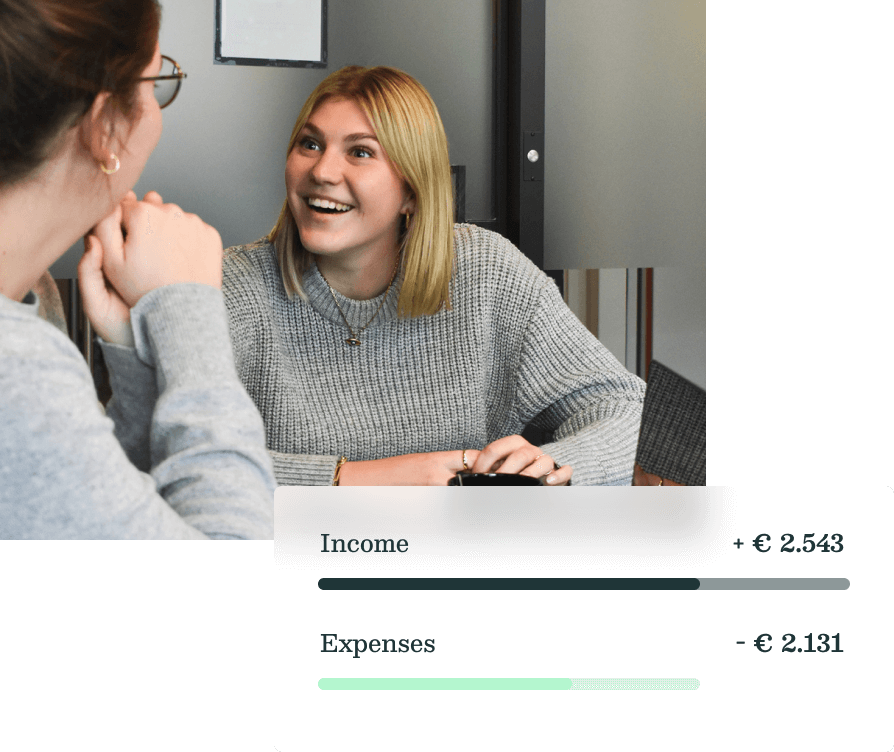

Additionally, an employee can get in touch with one of our financial coaches. They do not stand above the employee but beside them. They show the possibilities, give advice, help where necessary but do not make decisions for them.

#fit #flex #finance

Financial health as a prerequisite for vitality.

More and more employers are concerned with the vitality of their employees. What is often overlooked in this regard is the financial aspect, despite its significant impact on workplace health. This not only affects the individual but also their job performance and immediate surroundings.

For a fixed amount per employee per year, Able ensures the financial resilience of all employees.

We are here for you as an employee.

A secure platform where information, group training, and individual financial coaching are available. What does Able do for you as an employee?

Safe and anonymous

What you share with us stays with us. Employers sign an agreement at the start of the collaboration indicating their agreement to complete anonymity. Of course, if you prefer to involve your employer in the process, you are always welcome to do so.

Personal contact

We are happy to come and visit you, and you can always call us. It is important for us that you feel heard and feel comfortable coming to us with questions. We are happy to brainstorm with you!

Sustainable solution

Every situation is different, and everyone has different needs. We understand this, which is why we do not dwell on the problems but instead work together to find a sustainable solution. One that fits you and your lifestyle.

Debt-free together

By not only offering assistance when there are financial problems but also training for detection and prevention tips, we aim to get as many people debt-free and keep them that way.

For employers

Employers can make an important contribution to early resolution of financial problems by lowering the threshold for seeking help. The employer also benefits from having financially healthy employees. This leads to less absenteeism, better productivity, and ultimately demonstrates good employership.

An employer who takes responsibility not only pays the salary but also does everything possible to ensure that everyone can function financially healthy. That is sustainable employership in 2023.